Your payments and direct debits in SEPA format

SEPA is the Single Euro Payments Area, which was established in 2002 to harmonize national and cross-border payment instruments. The format is used for SEPA Credit Transfers (SCT) and SEPA Direct Debits (SDD) in Europe.

Payment methods harmonisation thanks to SEPA

SEPA (Single Euro Payments Area) is the single European area for payment in euros within which payment methods have been harmonised.

SEPA was put in place to simplify payment management, reduce processing and banking costs and reduce processing times.

The SEPA zone includes 37 countries:

- The 27 Member States of the EU

- Iceland, United Kingdom, Liechtenstein, Norway, Switzerland, Monaco, San Marino, Jersey, Guernsey and the Isle of Man.

Economic agents in these countries (companies, traders, individuals, public authorities) are able to make payments in euros in identical conditions within this area as easily as they can in their own country.

The SEPA Credit Transfer (SCT)

- The destination account and bank are identified using the combined BIC/IBAN

- 140 characters of descriptive text

- Turnaround time of 1 working day

The SEPA in Cegid Exabanque

The SEPA in Cegid Exabanque enables creditors to carry out debit transactions in euros from customer (debtor) accounts in all countries within the SEPA zone

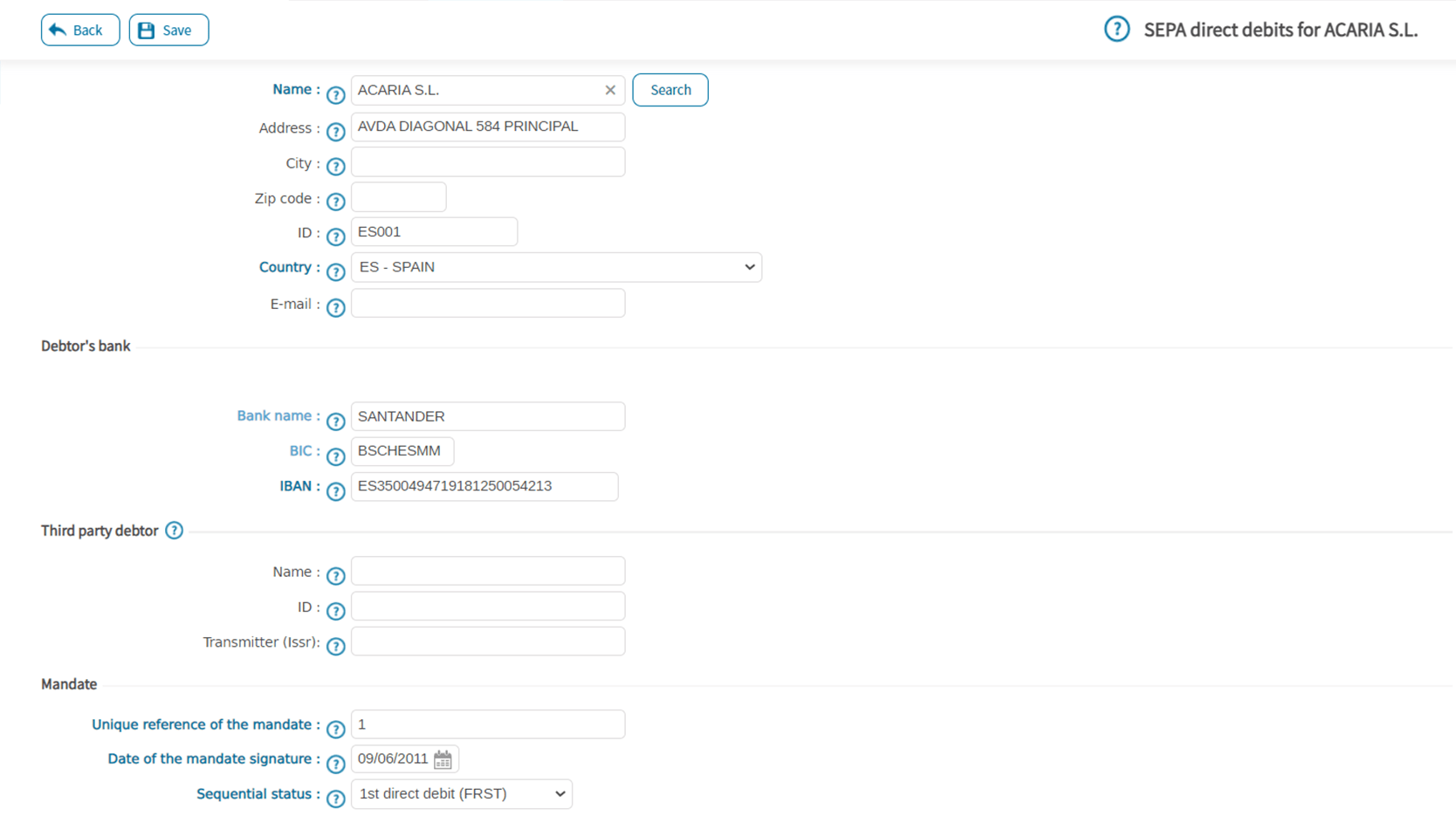

In order to set up Sepa in Exabanque, the creditor must:

- Have a SEPA Creditor ID (ICS) provided by their bank

- Set up Exabanque authorisations called “mandates” and have these signed by the debtor

- Have the debtor’s BIC/IBAN banking information

- Inform the debtor of the direct debit to come (pre-notification)

- Send the SDD order to the bank

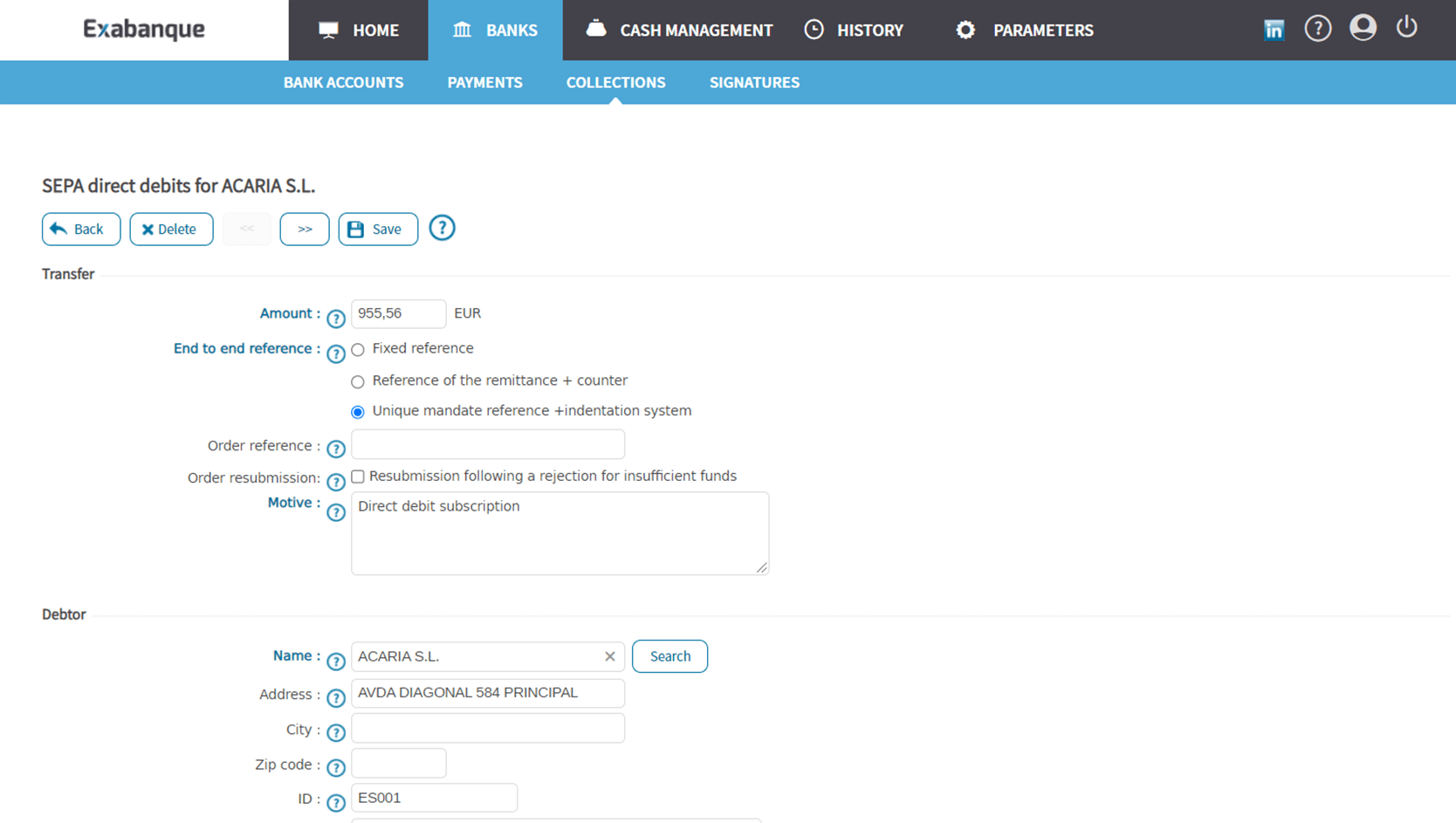

Every SEPA in Exabanque includes the following information:

- The unique mandate reference (UMR): a code which enables each debt to be identified (set by the creditor)

- The payment status (sequential status):

- OneOff: for a direct debit made once only

- First: for the first direct debit of a series

- Recurrent: for the recurring transactions in a series

- Final: for the final direct debit in a series

- The mandate signature date

*Since 2016, first status (FRST) is optional. All direct debits now have a Recurring (RCUR) status.

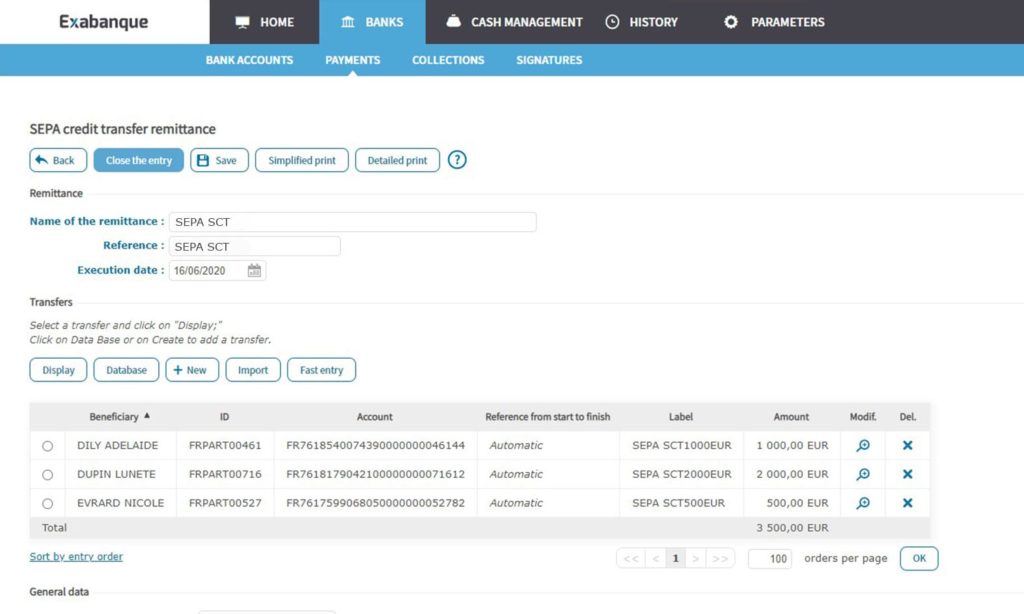

The SEPA SCT in the Cegid Exabanque software

Cegid Exabanque enables you to:

- Enter BICs/IBANs into the database

- Set up lists of SEPA transfers and remittances

- Generate and send files in XML ISO 20022 format

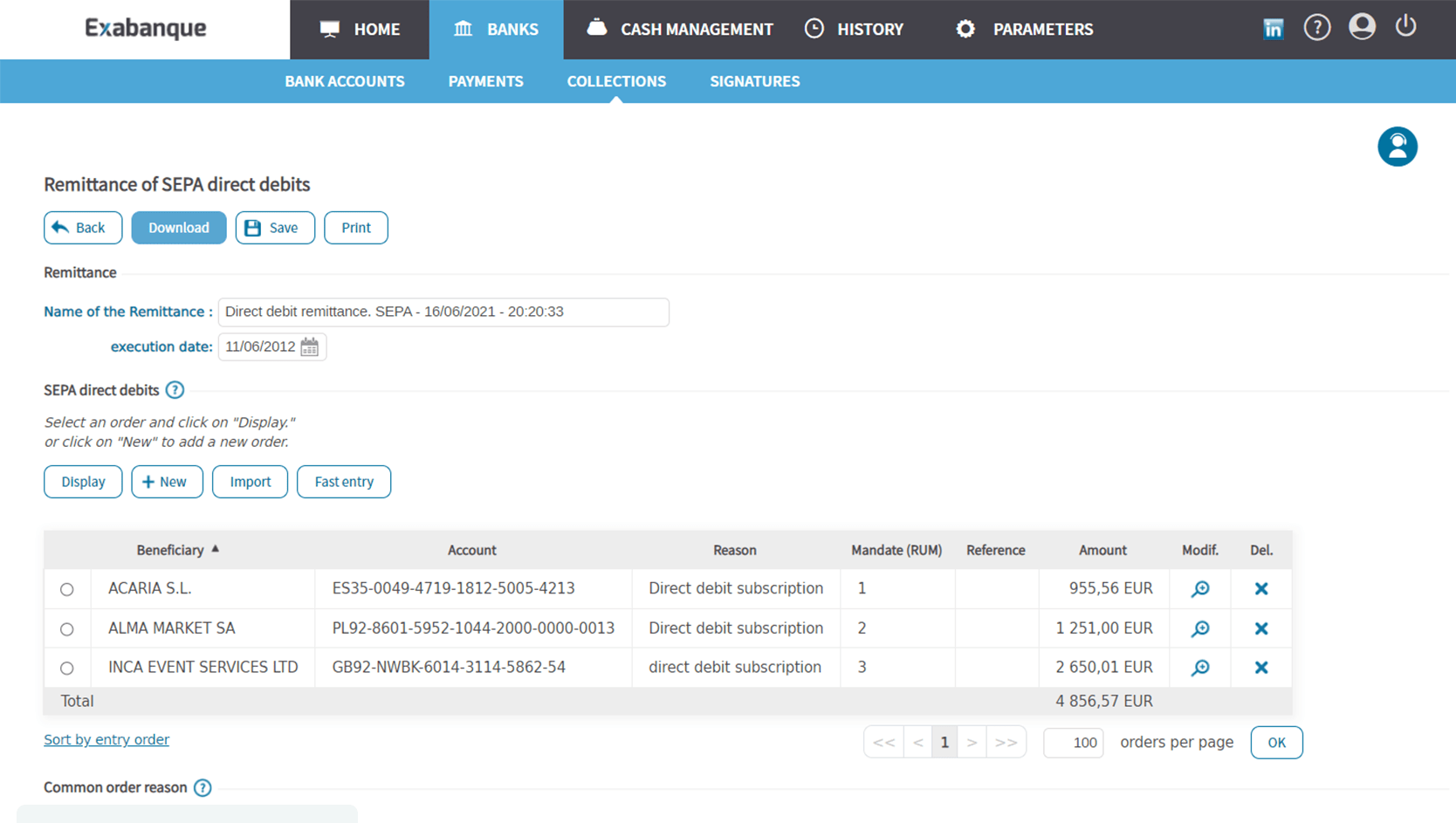

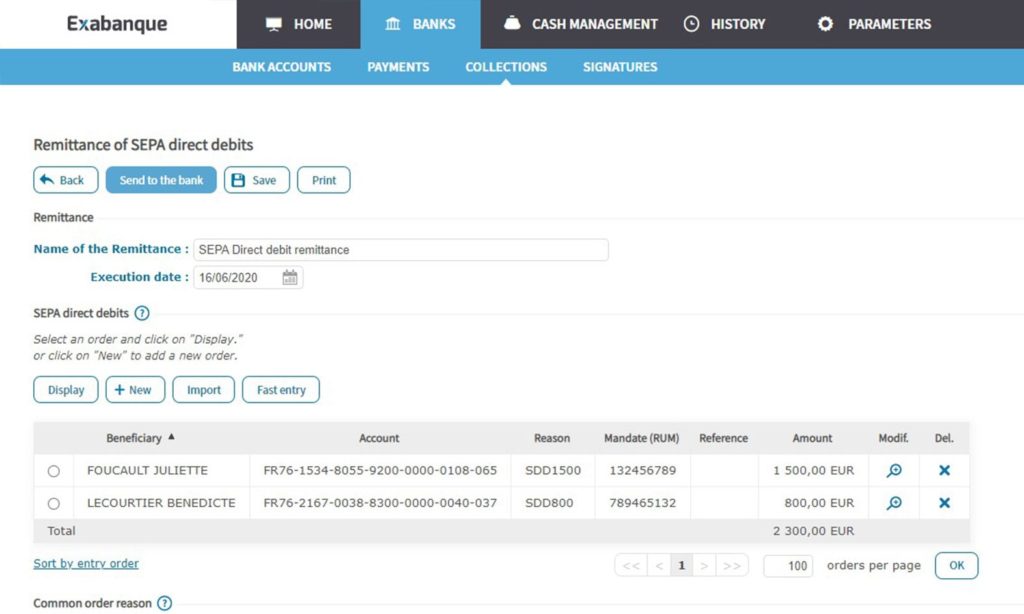

The SEPA SDD in the Cegid Exabanque software

Cegid Exabanque enables you to:

- Enter BICs/IBANs into the database

- Set up lists of SEPA in Exabanque and remittances

- Save the mandate data

- Update the mandate data upon each transmission to the bank

- Generate and send files in XML ISO 20022 format

Cegid Exabanque is compatible with the formats used by all European banking institutions: pain.001.001.02, pain.001.001.03 and pain.001.002.03.

For France, the program has a BIC/IBAN module, which automatically converts the RIB (account information) into the BIC/IBAN. It also allows the reformatting of transfers in CFONB format into SEPA transfers in one simple click.